Believe it or not social media scams have been picking more pockets than any other scam today––including phone call and text fraud.1

There have been more than

How much do you need to retire wealthy?

Believe it or not, there’s no set number for anyone.

Lifestyle and the quality of your retirement plan are certainly

Read More

What’s your ideal retirement?

Traveling? Practicing your favorite hobbies? Caring for loved ones?

Whatever you envision, creating a plan of action can feel

Read More

Smart investing doesn’t happen in a vacuum.

Current events matter, and this year, the 2024 Presidential Elections are taking center stage.

That’s rattling a

In a perfect world, every money decision we make would be totally rational.

We’d consider all of the facts. Then, we’d balance them with the risks to make the

Life insurance can fulfill many needs not the least of which is retirement. In can be underwritten on a tax-qualified basis or non-tax-qualified basis.

Read More

Group life Insurance is an employee benefit that is lent to an employee while they are working for their employer. It is by no means permanent protection and

Read More

Three points to know and consider concerning compound interest.

Read More

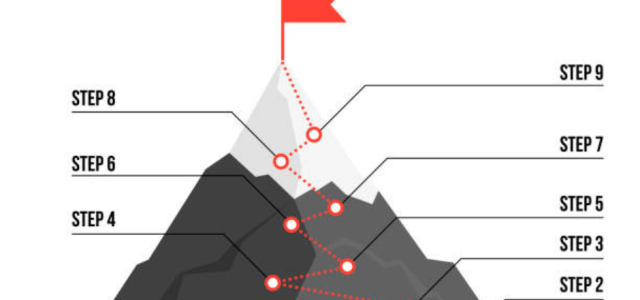

Below are 9 Principles to consider when you are investing.

Read More

Financial awareness is both a mindset and a strategy that ensures you’re making, spending, saving, and investing money in a way that maximizes your chance of

Read More

You’re finally ready to move up from your rental unit to your own home. Before you start searching for a home, understand how much money you’ll really need. Be

Read More

Annuities are not just for retirees; young investors can take advantage of many of their features as well.

Read More